SEC securities issuers forum (SIF).

The inauguration of the Securities Issuers Forum (SIF) which took place during the virtual meeting by the Security and Exchange Commission, SEC and in collaboration with Nigeria Employers Consultative Association, NECA, on Wednesday, in Lagos is a step towards the improvement of contributions of issuers to the development of the capital market.

The SEC has said it is positive that the SIF would encourage more listing, improve the business environment and enhance the contribution of the capital market.

- The SEC proposed rules on Robo-Advisors in Nigeria

- SEC Regulatory Incubation (RI) program for FinTech operations

- The SEC Nigeria rules on crowdfunding – an overview

- World Food Programme, WFP concerned about food security in Nigeria in 2021

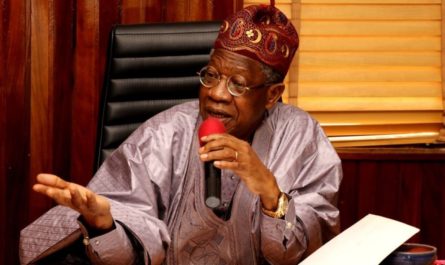

According to Mr Lamido Yuguda, the Director-General, Securities and Exchange Commission (SEC) “the idea of a forum for issuers of securities is not novel as it exists in other parts of the world to cater to the interests of issuers of securities in the capital market.”

The European issuers, American Securities Association, and the Debt Issuers Association are among similar associations mentioned by the DG.

More so, it will promote healthy competition, sound cooperation and ethical conduct among members.

Forums for issuers are not very common in the African region, Yuguda noted. However, “they have proven to be veritable tools for capital market advancement in the UK, Europe and Asia,” he said.

The SIF will not only act as a potential bridge between the commission and issuers of securities but also, it will create a platform for issuers to engage the commission for more listings.

The SIF

With this collaboration, the SEC will have a way to address issues relating to compliance with regulatory requirements as well as develop new products to meet funding needs.

The SEC also expects to see an improvement of contributions from issuers to the development of the capital market.

SIF inaugural edition holds on Wednesday, August 4, 2021.