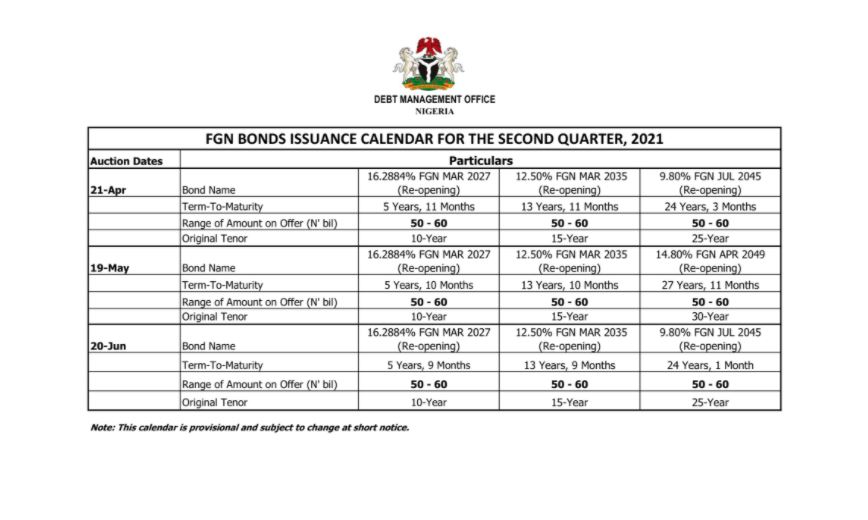

The Debt Management Office (DMO) of Nigeria has compiled the list of Federal Government, FGN 2021 Bonds issuance.

The Federal Government of Nigeria (FGN) is the issuer of the bonds and the DMO has the authority of the FG to receive applications on its behalf.

The schedule for FGN bonds by the DMO for 2021 are as follows:

For April 21 Auction date:

- Bond name: 16.2884% FGN March 2027 (re-opening)

- Term of maturity: 5 years, 11 months

- Range of amount on offer: 50-60

- Original tenor: 10-year

- Bond name: 12.50% FGN March 2035 (re-opening)

- Term of maturity: 13 years, 9 months

- Range of amount on offer: 50-60

- Original tenor: 15-year

- Bond name: 9.80% FGN July 2045 (re-opening)

- Term of maturity: 24 years, 3 months

- Range of amount on offer: 50-60

- Original tenor: 25-year

For May 19 Auction date

- Bond name: 16.2884% FGN March 2027(re-opening)

- Term of maturity: 5 years, 10 months

- Range of amount on offer: 50-60

- Original tenor: 10-year

- Bond name: 12.50% FGN March2035(re-opening)

- Term of maturity: 13 years, 11 months

- Range of amount on offer: 50-60

- Original tenor: 15 year

- Bond name: 9.80% FGN July (re-opening)

- Term of maturity: 24 years, 3 months

- Range of amount on offer: 50-60

- Original tenor: 25-year

FGN March 2021 Savings Bond is up for subscriptions – DMO

Debt to GDP ratio at 21.61% (N32.91trn) – DMO

For June 20 Auction date

- Bond name: 16.2884% FGN March 2027 (re-opening)

- Term of maturity: 5 years, 9 months

- Range of amount on offer:50-60

- Original tenor: 10-year

- Bond name: 12.50% FGN March 2035 (re-opening)

- Term of maturity: 13 years, 10 months

- Range of amount on offer: 50-60

- Original tenor: 15-year

- Bond name: 9.80% FGN July 2045 (re-opening)

- Term of maturity: 24 years, 3 months

- Range of amount on offer: 50-60

- Original tenor: 25-year

DMO lists Sukuk bond of N162.5 billion on NSE, FMDQ

Nigeria: OMO offerings to non-residents soon phasing out – CBN