There are very few ways to live out retirement in Nigeria. While most people are able to cover retirement cost with pension fee, there’s also the issue of delayed pensions in Nigeria.

This is the one reason workers in Nigeria plan their own retirement. With a little research on how to plan ahead, no one has to become helpless after retirement in Nigeria. This article is a good way to start researching.

How to Plan Ahead a Cost-Effective Retirement in Nigeria

Without an active social security system in Nigeria, think about setting up an account for your retirement. You have the option to either create a savings account or an investment account. This is a top priority and this is where most people get it wrong.

Savings accounts pay almost nothing unlike fixed or investment accounts and you should factor that in. FCMB, Stanbic IBTC, UBA, Zenith and many other Nigerian banks offer investment service where people can grow their money. Once you have set up an investment account, you can follow it up and manage it monthly. Just setting it up isn’t enough.

How Much do you need in your Retirement Account?

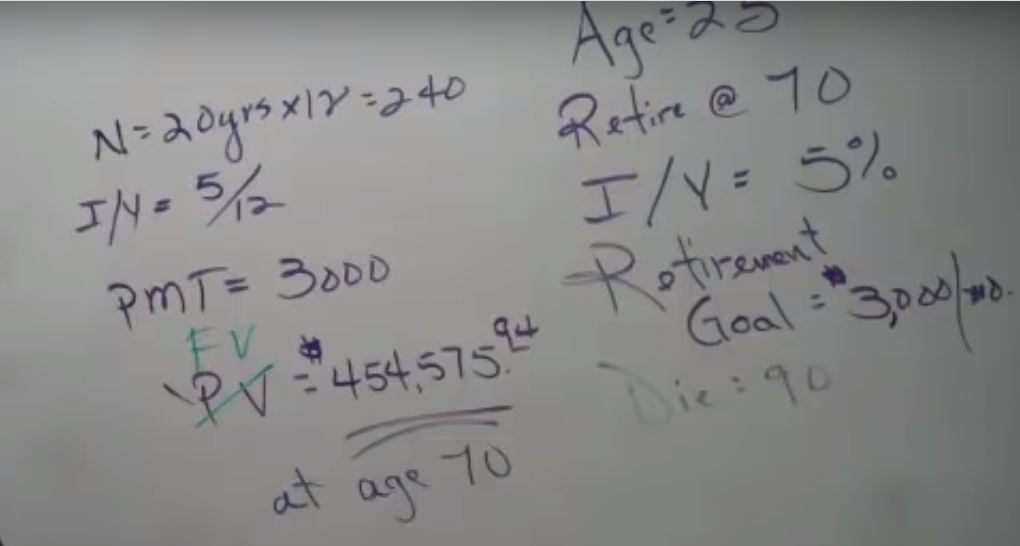

Depending on your income, the amount needed to retire differs from person to person. Many in Nigeria are faced with low wages and are not able to save enough for retirement. So, you might want to seek the help of a professional here. They will tell you how much you need to save in your retirement account every year – considering items like inflation and income.

Without an operative social security system in Nigeria, it is best to choose your retirement lifestyle carefully and avoid cost demanding behaviour. Some of the most essential needs to also think about include:

- Health Care – Government healthcare insurance in Nigeria can help you get by during retirement. If you are hoping to get more sophisticated health care, then you might have to raise your monthly budget for healthcare.

- Accommodation – Mortgage system does not function in Nigeria, so assuming you already own a property somewhere, you might want to settle there. It is critical to not have rent bugging you, but if your home is located in a big city, you might still have to spend too much on other things.

There are places in the world where retirement is cheaper than others and Nigeria is one. If you think about spending over $2000 every month living in the US for instance, then you are better off in Nigeria. You could avoid running out of money and be able to live reasonably for less than $500 monthly. No matter where you eventually settle, you must mind what you spend money on. Living lavishly every day might be bad for you and will make you run out quickly.

Follow us on Facebook and Twitter for new posts on Africa and Business in Africa.