The introduction of the e-naira by the Central Bank of Nigeria, CBN as a scheme in the protection of the local currency could also give Nigeria’s financial system a major boost.

The financial system in Nigeria has been challenged by protracted foreign currency inflow, the FX gap between the NAFEX and black-market rate and dollar shortage.

In all, a digital naira is capable of cutting down the challenges by more than half.

The International Monetary Fund has cautioned against the hasty approach to digital currency, CBDC by Central Bankers.

However, the introduction of digital currency for Nigeria could offer Nigeria a solution for its foreign exchange interactions that are mostly subordinate to oil exports.

- CBDC in Nigeria – things to know as CBN launches digital currency, e-naira

- What $3.4bn SDR from IMF means for Nigeria and its foreign reserve

- Things to know about the CBN, federal reserve, monetary policy

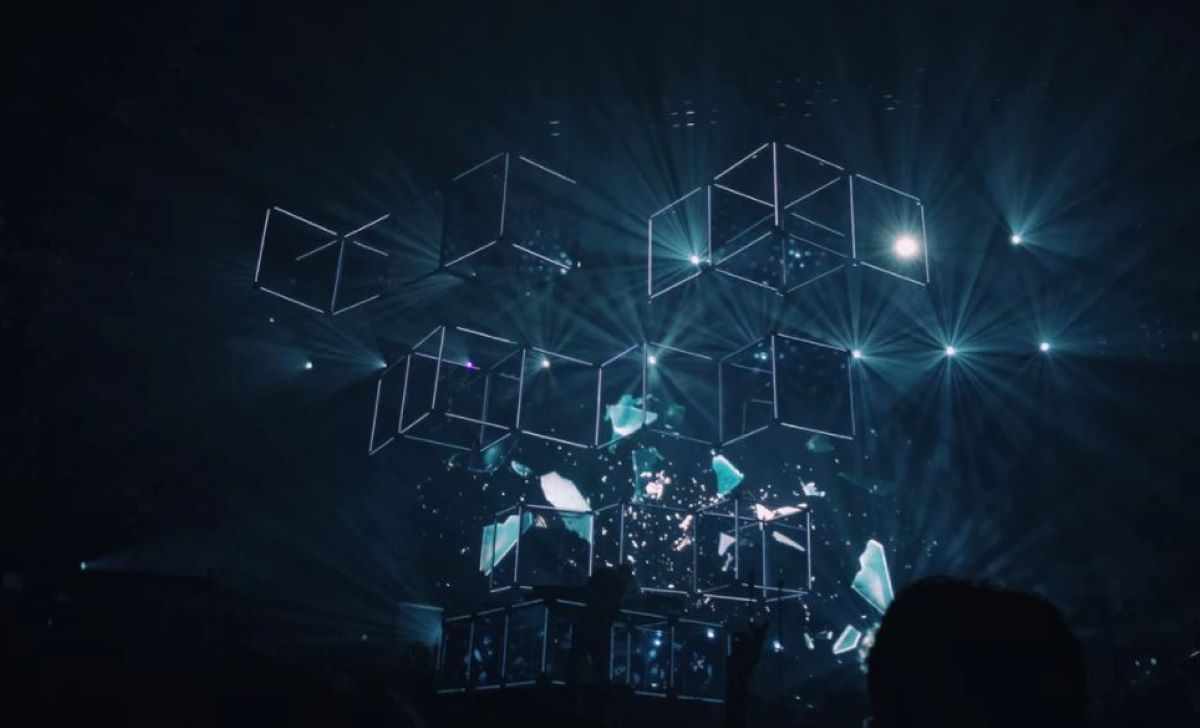

CBN e-naira

The influence of the e-naira on the monetary policy, foreign exchange supply and the exchange rate is within the corridors of the CBN’s objective as well as its responsibilities to FX.

CBN policies – ban on cryptocurrencies and Naira 4 Dollar scheme have attempted to reverse pressure on the naira.

The Naira 4 Dollar scheme was especially to drive remittance inflows in addition to licensing more IMTOs to encourage competition.

But, how is a digital naira any different from cryptocurrency and was it necessary to ban crypto use in Nigeria.

The e-naira bank digital currency possesses features that will allow direct handling by the CBN.

However, cryptocurrencies are private and could severely impair, reduce the relevance of the naira and tamper with its value.

A digital naira or e-naira will further synchronise with Nigeria’s financial institutions and current payment systems. Finance institutions will implement digital cash to account owners on all levels.

More so, existing payment systems will enable financial institutions to carry out transactions in real-time.